從 SMCI 法說稿,推敲 NVDA 的表現

SMCI 需要 NVDA 的 GPU 才能出貨,那 SMCI 大幅上調業績展望,是否代表著 NVDA 又將再次一飛沖天?

【看圖說故事】

SMCI 雖在 2024/01/18 公布大幅優於預期的預覽而暴漲,但當下華爾街基本上都沒有調整對 他的期望;只有在 SMCI 正式公布 FY24Q2 季報、大幅調升 FY24 營收與獲利展望之後,分析師不得不認輸地上調 FY24 與 FY 25 的營收與 EPS 展望;

SMCI 需要 NVDA 的 GPU 才能出貨,那 SMCI 大幅上調業績展望,是否代表著 NVDA 又將再次一飛沖天?

分析師對 SMCI 的營收預期 (20240205):

FY24 :自123.00 億上調為 144.71 億;(比 SMCI 本身的營收展望來的保守)

FY25 :自149.71 億上調為 194.69 億;

原先 FY24 營運展望是 100 億,中長期展望是 200 億,現在看起來肯定會提前達標,到底為什麼這麼有信心?

分析師對 SMCI 的 EPS 預期 (20240205):

FY24:自 $18.990上調為 $21.295 ;

FY25:自 $22.353上調為 $27.291;

【看圖說故事】根據公布 FY24Q1 時提供的營運展望 (以中位數) 來推估,可以從左圖看到,Q3 將是傳統淡季,與 Q2 相比將呈現季減;但最新的營運展望來看,FY24 全年將呈現逐季走高的趨勢,將不會有淡季效應;

SMCI 過往習慣給予保守的營運展望,FY24Q3 應該還有更大的成長空間才是,或許仍有優於市場預期的機會?

FY24Q3:37 - 40 億美元;

FY24:自 100 - 110 億美元大幅上調為 143 - 147 億美元;

【看圖說故事】

分析師上調對 SMCI 的營運展望,對 NVDA 有甚麼影響嗎?

文章的最後,再來看 NVDA 的獲利展望是否有被上調?

企業信心:對技術能力很有信心;

基於 $NVDA HGX-H100 所進行的訓練相關 (深度學習和優化 LLM ) 的 AI 機架規模解決方案,持續受到市場的高度歡迎;另外,以 #AI 推理系統為主的解決方案的需求也開始出現成長。

Our #AI rack-scale solutions, especially the Deep-Learning and LLM-optimized based on $NVDA HGX-H100, continue gaining high popularity. The demand for #AI inferencing systems & mainstream compute solutions has also started to grow.

AI 的創新速度不斷加速,SMCI 處於革命的最前沿;SMCI 開發最具創新性的 AI 基礎設施,在多數平台上為幾乎所有行業和垂直市場提供機架級規模的服務,並以此領先全球同業。

$SMCI is at the forefront of the #AI revolution, where the pace of innovation is accelerating. We are leading the race by developing the most innovative #AI infrastructure on many platforms at rack scale, for almost any industry & for any market vertical.

SMCI 已將 AI 相關的產品線翻倍,包括 $NVDA CG1、CG2 Grace Hopper Superchip、H200 和 B100、優化推理的 GPU - L40S、AMD MI300X/MI300A 以及 Intel 的Gaudi 2 和 Gaudi 3 等產品,並已經準備好在即將到來的月份與季度為這些新平台進行大規模生產。

As the market leader, we have been preparing to more than double the size of our current AI portfolio with the coming soon $NVDA CG1, CG2 Grace Hopper Superchip, H200 & B100 GPUs, L40S Inferencing-optimized GPUs, $AMD MI300X/MI300A, & Intel’s Gaudi 2 & 3.

All these new platforms will be ready for high volume production in the coming month & quarters.

利用模塊式架構 (building block architecture) 和自動化系統(運營與生產),SMCI 能以更有效的方式提供客製化的機架解決方案,該解決方案具有即時、高品質等優勢,比競爭對手更快交貨。

Leveraging our building block architecture & operation/production automation systems, we can deliver optimized rack solutions with time-to-market & quality advantages for our customers more efficiently than competition.

交付時間 (TTD) 持續提升; 預估 FY24Q4 ( 2024/3- 6) 時,將具備大規模生產 100 -120 KW + 液冷 (liquid-cooling) 解決方案的能力,直接液冷的機架月產能將達 1500 組,總機架月產能將達 5000 組,而無塵的機架級大規模生產設施也將同時為重要客戶提供服務;

Our TTD, Time-to-Delivery factor has been in a continuous improvement.

By this June quarter, we will have high volume, dedicated capacity for manufacturing 100 kilowatt to 120 kilowatt racks with liquid-cooling capabilities, providing direct liquid cooling racks capacity up to 1,500 racks per month & our total rack production capacity will be up to 5,000 racks per month by then.

At the same time, our high volume clean room rack-scale production facility will be ready to service critical customers very soon.

美國、荷蘭和台灣的生產設施的利用率平均為 65%,正迅速達到滿載的階段;為解決當前的產能限制,將在矽谷總部附近再新建兩個生產設施和倉庫,幾個月內就將正式營運;馬來西亞新廠將專注於模塊式架構 (building block architecture),以更低的成本來擴大產量,同時搭配其他新設施,預估年營收規模將可超過 250 億美元。

Today, our production utilization rate is about 65% across our USA, Netherlands & Taiwan facilities, & they are quickly filling.

To address this immediate capacity challenge, we are adding two new production facilities & warehouses near our Silicon Valley headquarter, which will be operating in a few months.

The new Malaysia facility will focus on expanding our building blocks with lower costs & increased volume, while other new facility will support our annual revenue capacity above $25 billion.

營運表現:伺服器業務明顯受惠於 AI 趨勢;

營收年增率超過 50%;(1) 伺服器和儲存設備的營收年增 107% 至 34.36 億美元;(2) 各種子系統和配件的營收年增 61% 至 2.29 億美元;

Vertical Markets:

Enterprise/channel vertical:1.48B, +55% yoy & +62% qoq, driven by enterprise #AI & CPU upgrade programs

OEM appliance & large DC vertical: $2.15B, +175% yoy & +83% qoq. Two existing CSP/large DC customers represented 26% and 11% of total revenues.

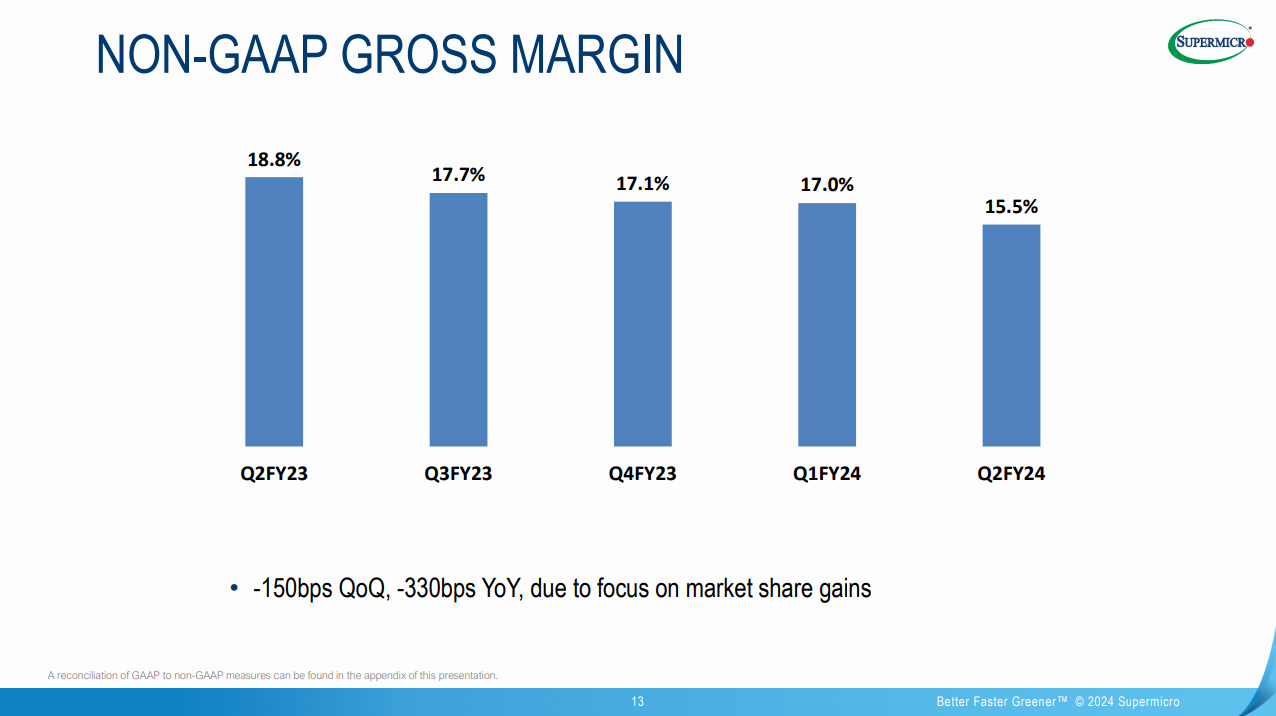

成長動力:主要來自 AI/GPU 和機架級總 IT 解決方案,營收占比超過 50% (企業/渠道、OEM/大型數據中心皆如此)。產品平均價格呈現年增與季增,主要受惠於產品和客戶組合轉佳;調整後毛利率約為 15.5%,低於前季的 17%,主要是因為積極獲得策略性新設計、取得市占率。

Growth was driven by AI/GPU & rack-scale total IT solutions, which again represented over 50% of total revenues with #AI/GPU revenues in both the enterprise/channel & the OEM appliance/large DC verticals.

ASPs increased yoy & qoq, driven by product & customer mix.

non-GAAP gross margin was 15.5%, which was down qoq from 17% as we continued to focus on winning strategic new designs & gaining market share.

毛利率:2021 年 3 月時設立的目標為 14% - 17%,目前實際執行情況優於目標,有許多因素對 SMCI 有利,產能擴張讓我們得以大幅降低成本,而模塊式架構 (building block architecture) 讓我們以最快將產品上市,有助於推出完整解決方案,與同業做出區隔;

We set out a target back in March of 2021 of 14% to 17%. We've actually done pretty well against that target.

There's a lot of initiatives that play into our favor.

We're doing a lot in terms of expansion to lower our cost envelope.

Our advantage is our building block solutions & we're the fastest to market because of the way that we have architected our products.

First-to-market advantage helps to differentiate ourselves as we come out with a complete set of solutions.

客戶:與 FY24Q1 相比,營收占比達 26% 的客戶為同一個客戶;營收占比為 11% 的客戶也是長期客戶,只是這次該客戶首次超過 10% 的門檻;當營收規模進一步擴大時,將有更多大型客戶,以及更多中小型客戶下單;

The 26% customer is the same customer.

But the 11% customer is not a new customer, and it's a longer-term customer. But first time in 11% & to your point, yes, we do see a bouncing in & out, and we're very happy. Anytime they do bounce about by the way.

when we further grow our total revenue, we will have a more large scale customer & more middle-sized % small-sized customers as well.

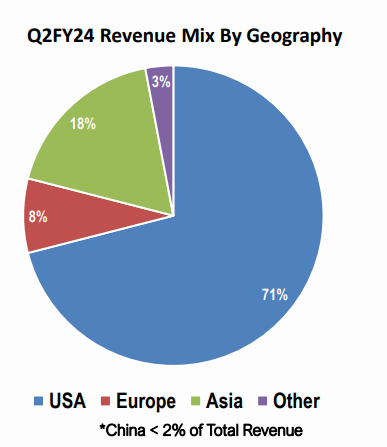

區域:以美國為主;來自中國的營收小於 2%;

YOY:US +139%, Asia +98%, Europe -8%, & rest of the world+67%.

QOQ:US +61%, Asia +191%, Europe +51%, & rest of the world +37%.

現金轉換率:自 FY24Q1 的 86 天降為 FY24Q2 的61天,存貨週轉天數、應收帳款天數與應付帳款的天數都下降,顯示供應鏈和資金管理方面有更好的執行能力,經營效率和現金流狀況都出現明顯的改善;

Q2 cash conversion cycle was 61 days vs. 86 days in Q1.

Days of Inventory decreased by 24 days qoq to 67 days due to the timing of shipments during the quarter.

Days sales outstanding was down by 14 days qoq to 29 days

Days payables outstanding decreased by 13 days to 35 days.

分析師 Q&A 時間:

AI 潮流:將持續好幾個季度,如果不是數年的話;連同推理和其他計算需求等整體生態系需求,整個 #AI 革命將持續數十年。

Overall, I feel very confident that this #AI boom will continue for another many quarters, if not many years.

Together with the related inferencing & other computing eco system requirements, demand can last for even many decades to come, we may call this an #AI revolution.

由於需求非常強勁,FY24Q3 也會強勁成長,不會出現過往的淡季效應;

Q. March quarter revenue is seasonally down Q-o-Q, guiding to be up Q-o-Q. Usually when the revenue is down seasonally quarter-on-quarter, your cash conversion cycle goes on a Q-o-Q basis, this March quarter because you're projecting a Q-o-Q revenue increase, does that change your expectations on cash conversion cycle seasonality dynamics?

A. because of the demand, it is very strong. So we believe this March quarter will be a strong quarter as well.

銷售量與產品售價:過去兩年,主要是平均售價 (ASP) 快速提升;在未來幾年,銷售數量的成長將更快,數量成長將快於平均售價的增加。

I guess in the next few years, our growth will be quicker in terms of unit number.

Volume growth will be quicker than ASP, because last two years, our ASP have been growing a lot.

So I guess unit number, volume will grow faster.

獲利能力:預計 Q3 毛利率將略低於 Q2;營業費用約 2 億元,包含 3900 萬美元的以股份為基礎的薪酬費用;隨規模效益持續擴大,營業利益率將維持穩健。

We expect gross margins to be slightly lower than Q2 levels.

GAAP operating expenses are expected to be approximately $201 million & include $39 million in stock-based compensation expenses that are not included in non-GAAP operating expenses.

(Q2 OpEx on a GAAP basis increased by 6% qoq & 58% yoy to $193m, driven by higher compensation expenses & headcount.)

The good thing is that when we continue to grow our economies of scale, our operation margin indeed will be still able to keep in healthy position.

經濟規模:在過去 30 年一直處於小規模生產的狀態;直到最近,產量才真正開始以經濟規模的方式進行成長,SMCI 將把握機會,繼續利用規模優勢來擴充,同時利用自動化系統來提升銷售、運營和服務能力。

A. if there is any change to your OpEx growth formula. It's been on a trailing basis, less than half of our revenue growth is as you grow bigger & do you expect to run against any limit in supporting such a large customer base & potential customer base or are you getting more economies of scale as you grow larger with that?

Q. we had been some low-volume company for 30 years. So our volumes just started to grow in kind of good economical scale just recently. We like to take this chance to continue & grow our economies of scale. So when our economies of scale grow, we leverage automation system again for sales, for operation, and for service. We are in good position to continue growing quickly.

供給與需求:訂單規模很大,而且持續增加,影響交貨的唯一因素是供應;好消息是供應情況持續在改善,而供應限制也讓 SMCI 必須保持一定的理智和審慎。

We have a very large and growing backlog, which grew again this quarter.

Our only constraint is supply.

The good news is, supply is improving.

We have to be somewhat conservative, because we are constrained still by supply.

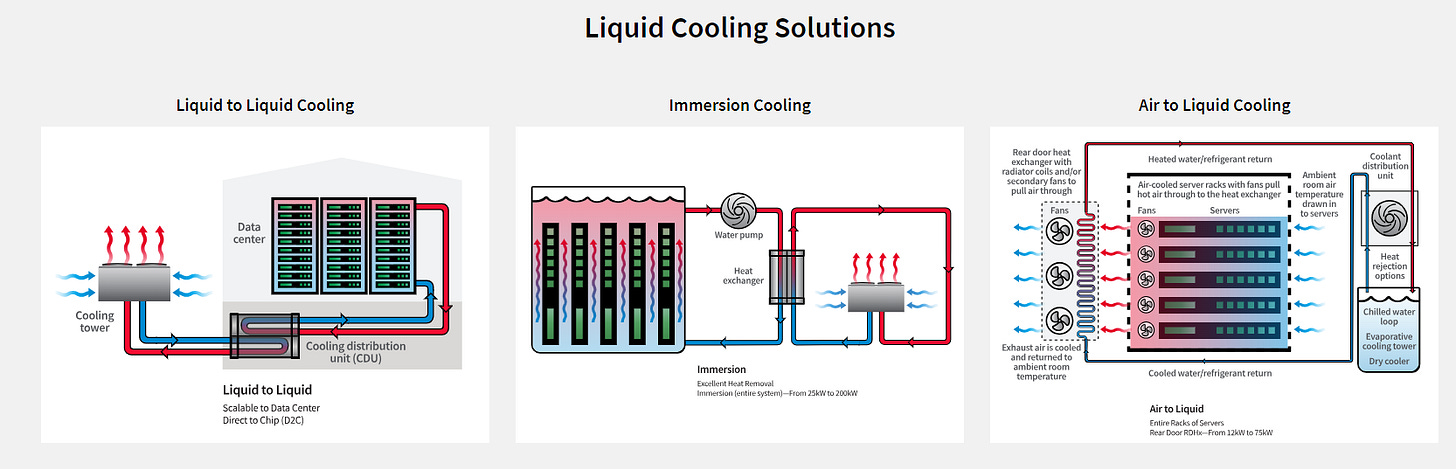

答非所問的營收展望,暗示 56 億並非不可行:按照月產能推算,營收規模可達 56 億美元,因此 H2 將達到 56億美元是否是合理的推測 ? 為, SMCI 建立大規模的液冷解決方案, 以盡可能提供綠色解決方案給客戶,SMCI 可支援液冷、空冷或混合解決方案,可以有不同情況的成長。

Q. The calculation of 15,000 racks per month resulting in around $5.6 billion per quarter. The question is if this continues at the mid-year point, would $5.6 billion per quarter be a reasonable run-rate opportunity estimate, rather than formal guidance, in the second half of the year.

A. We recommend green computing solutions for customers wherever possible. That's why we've built large-scale liquid cooling & other green capabilities.

The capacity is there to support customer needs. Our facilities are also flexible, able to support liquid cooling, air cooling, or hybrid solutions. We have significant capacity ready to support growth across different cooling solutions.

平均售價持續上漲,但未來單元數量將更快增長,因此需要更大產能的原因,而12月出貨已超過 17-18 億美元,年化產能已達 190 億美元的。

Q. First, at the FY24Q1 call, the capacity was $18b, that's up from $15b at FY23Q4. What's the driver of that actually increased capacity or increased ASPs. Your full-year guidance that implies a June Q guidance of around $4.7B, that implies that your annualized capacity is reaching $19 billion. And so as your capacity is increasing. Is this largely a mix-driven like-for-like ASP driven or how has your capacity actually gone up prior to Malaysia coming online?

Q. our ASP gradually continued to grow while that unit number will grow much faster from now on now I guess. So that's why we need more capacity. in December, we shipped over $1.7 billion -- $1.8 billion. And so that alone establishes a $19 billion capability.

CSP 客戶對目前處理 700 瓦模組的傳統氣冷方案感到滿意;但當功率增長到 1000 瓦時 (如 B100 GPU),多數資料中心就必須要為此預先做好準備,SMCI 持續提高可靠性和維護性等產品品質,以在客戶準備好要採用液冷能迅速供服務。

Q. Is it really the next generation, the B100s and sort of the 1,000 watt GPU class that really drives the adoption at your CSP customers, drives that need for liquid cooling.

A. In these current 700 watt module, people can still take care very well, that's why people still are comfortable with our traditional air cooler. But when grows to 1,000 watt per module, most of the data center will have facility ready for that. So we are very optimistic and very patient to continue to improve our quality, especially that reliability and easy for maintenance. So when customers are ready, we can dwell quickly to support them.

SMCI 相信液冷比重將繼續成長,但目前多數客戶仍採用氣冷的方式,因為基礎設施仍需更長時間準備,不過 SMCI 已為客戶準備好成熟的總解決方案、並搭配巨大的產能。

We have a huge capacity ready & very mature total solution ready, but lots of customers’ infrastructure needed some more time.

I believe liquid cooling percentage will continue to grow, but at this moment most of the shipping is still air cooled.

CPU 推論市場:除了在生成式深度學習領域持續地強勁成長之外,在通用型 CPU 客戶的推理商機也在成長。隨著 AI 獲得更廣泛普及,全球各產業都需要更多的推理解決方案,包括私有雲、自有資料中心等。

Other than generative deep learning segment continue to grow very strong.

Our inferencing opportunity in general #CPU customer base also growing.

With #AI continuing to be more popular, many vertical around the world need more inferencing solutions as well, including private cloud, private DC.

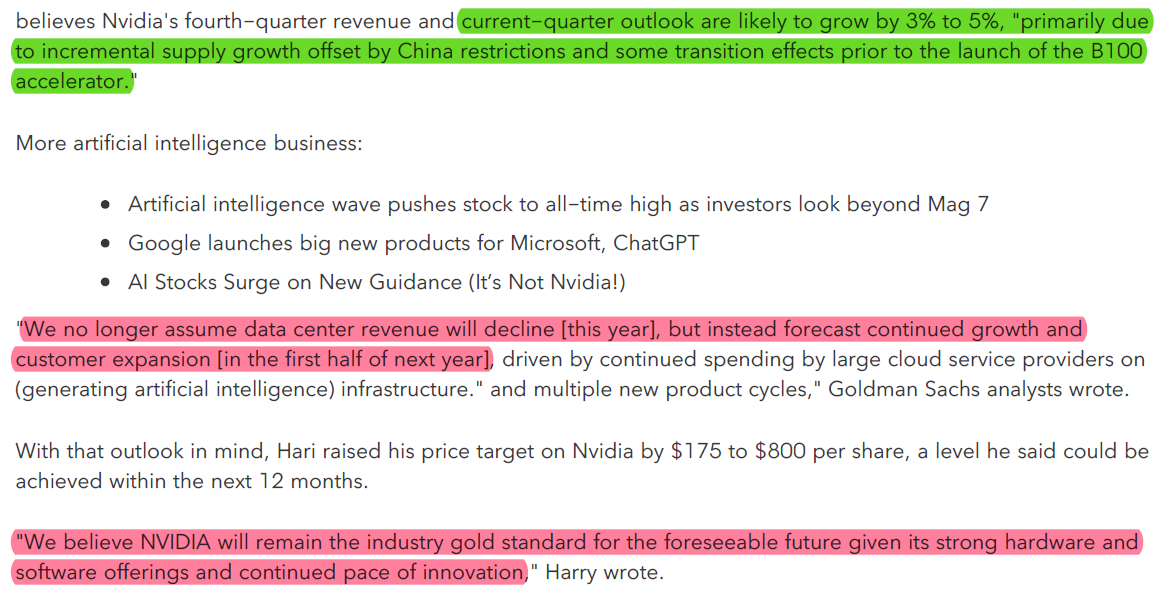

【看圖說故事】分析師對 NVDA 的展望

2023 年 5 月 15 日以來,NVDA 首次突破分析師給的平均 12 個月目標價 - $668.78,

營收 (20240205):

FY24 :自 591.06 億上調為 591.22 億;

FY25 :自 939.65 億上調為 943.09 億;

EPS (20240205):

FY24:自 $12.316上調為 $12.321 ;

FY25:自 $20.666上調為 $20.770;

$GS 給予買進的投資建議,目標價自 $625 上調至 $800

對可持續性越來越有信心,其 DC 營收不會在 2024 年下半年下降,尤其CSP 續投資,$MSFT + $META 對加速運算的需求維持強勁,加上客戶群持續增加,預估2025 年上半年還將持續成長。

H200 和 B100 新產品或續提升其地位

$AMD #MI300 有進展;$NVDA 在可預見的未來仍是產業黃金標準,因強大的軟硬體 + 持續創新

$BAC 給予買進的投資建議,目標價自 $700 上調至 $800

公布 FY25Q1 展望時,季增率可能只有3-5 %,約 5 - 10 億,主要是因為中國限制措施抵消供應的成長,加上下半年即將推出的 B100 的過度效應

與先前 10% 與 22% 的成長相比,3-5% 的季增率相形見絀,讓驚喜比過去幾季來的小,部分多頭或感到失望;

不過,謹慎將被視作為可持續成長創造更肥沃的基礎;企業對 GenAI 的採用尚未正式開始, 2025 年才會變得更加重要,$NVDA 受益於其在公有雲上的廣泛可用性,以及獨特的合作夥伴關係。

感謝分享! 想請教一下截圖裡的analyst's consensus是哪個軟體阿? 再次感謝大大分享!

非常棒的分析!!!感覺上市場集中在AI幾個代表股:$NVDA, $MSFT, $SMCI....連上游$TSMC 與 $ASML都是狂漲, 我只是很好奇!!這些熱潮有點像以前在炒作 FANG.....只是不知道是會持續多久?