SMCI 的 FY24Q3 法說內容,能否增加持股信心?

FY24Q3 營收再創新高,股價卻直直落,為什麼?本篇先整理 FY24Q3 季報,再整理法說重點;從法說會的討論,去試圖理解分析師擔心甚麼、又關心甚麼?以及推估驅動股價的主要因素;更進一步,我們將推估出 SMCI 已連續兩季各新增一名新客戶,而 NVDA B200 以上的液冷機櫃可能已經開始出貨!

【看圖說故事】FY24Q3 營收再創新高,主要受惠於 AI 解決方案的強勁需求,不過,股價卻是連番下跌,根據法說會內容來看,分析師除了想知道為什麼毛利率會下滑之外,更是不斷地旁敲側擊想要知道 AI 的需求是否維持高檔?

更重要的是, CEO 表示 SMCI 將在 FY24Q4 (2024年 3 月 - 6 月)出貨 1000 組液冷機櫃給最先進的客戶,甚至強調 10 萬瓦的機櫃已準備就緒,在 SMCI 與 NVDA 關係良好的前提下,是否暗示至少有 NVDA B200 以上 (B100 仍只需要 70 千瓦)的液冷機櫃將於 2024年 3 月 - 6 月期間出貨,對於 NVDA 即將於 5 月 22 日公布的FY25Q1 是否會有所幫助?

法說會的重點:

如果營收與獲利不會進一步成長,或許 SMCI 的估值很難再向上提升,股價也就會不進則退;

營收要成長,除了跟 NVDA GPU 的需求有關外,也跟 GPU 的供給有關,同時也跟 SMCI 本身的產能有關;

另一方面,獲利要成長,分析師關注的是毛利率的表現,同時間也必須要知道市場競爭是否對其獲利能力產生影響;

就目前來看,SMCI 與 NVDA 間的友誼,先前雖然讓 SMCI取得獨家供應,但在 NVDA 產能逐漸提升的前提下,伺服器同業似乎都已經開始可以出貨,是否已影響到 SMCI 這項獨特的兢爭優勢;

不過,SMCI 強調正在進行重大投資以支持其快速成長,除了馬來西亞廠的產能將放到最大,在美國似乎也即將蓋新廠;

當新產能上線後,營收也將有進一步成長的空間,目前預估 2024 年剩下的季度都會呈現季增走勢 (FY24Q4+FY25Q1+FY25Q2 ),維持淡季不淡,CEO 甚至發下豪語,未來幾年都會成長,並預計將繼續提高市占率;

另一方面, SMCI 特別強調其 DLC 液體冷卻技術的優勢,雖在短時間內對毛利率會有負面的影響,但長期來看,以其設計能力,SMCI 是有把握可以維持其毛利率,希望市場不要擔心他的獲利能力;

【Charles Liang】

We achieved another record-breaking quarter, with revenue of $3.85 billion, a 200% increase from same time last year, and non-GAAP earnings per share of $6.65, up more than 308% year-on-year.

Now, let's go over some key financial highlights. Supermicro is pleased to be included in the prestigious S&P 500 Index last quarter. Fiscal Q3 net revenue totaled $3.85 billion, up 200% year-on-year, within our aggressive original guidance of March quarter. If not limited by some key component shortages, we could have delivered more. Fiscal Q3 non-GAAP earnings of $6.65 per share were well above $1.63 last year, which was above 308% year-on-year growth. Our increasing economies of scale contributed to better net profit. Our year-over-year operating margin and net income both continue to improve, and we continue to expect further benefits as we bring our Malaysia facility online later in this calendar year.

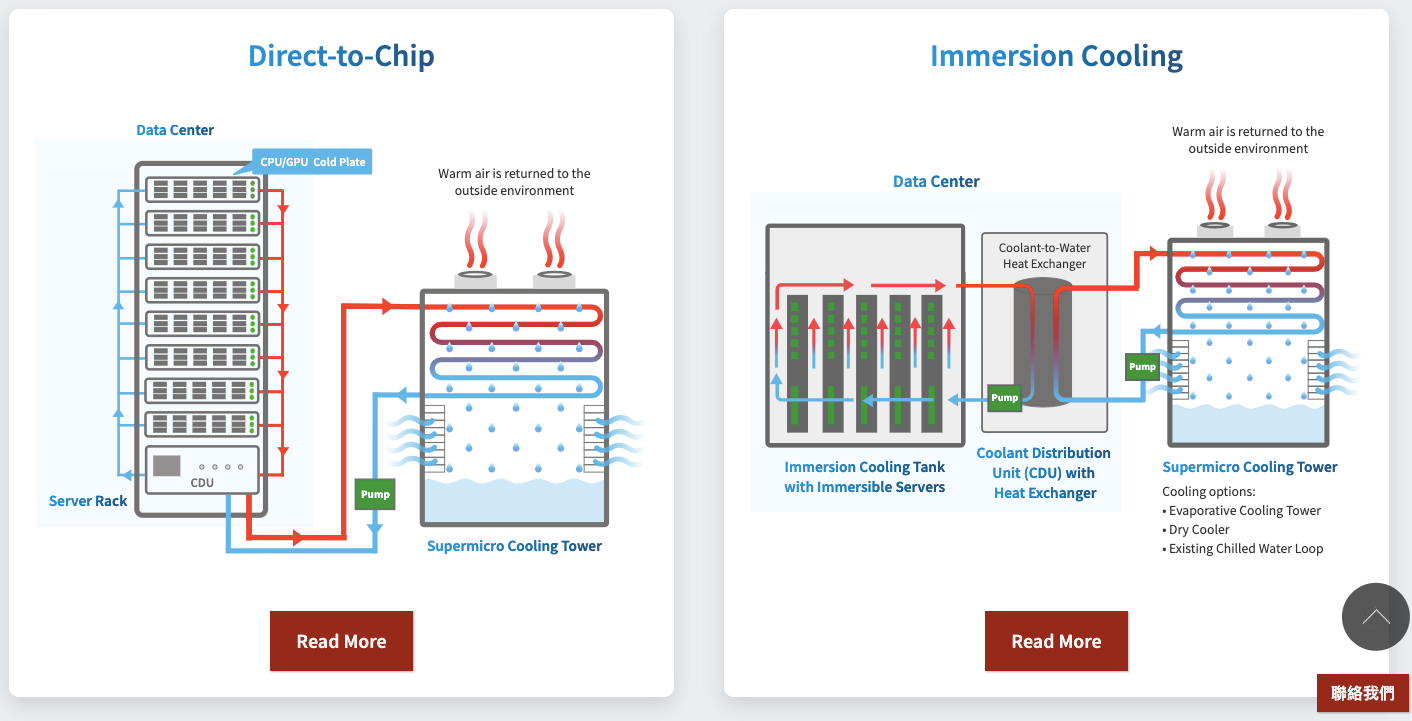

This fast-growing quarter was driven by end users wanting to accelerate their deployment of the latest generation AI platforms. Through our Building Block Solutions, we provide optimized AI solutions at scale, offering a time-to-market advantage and shorter lead time over our competition. Additionally, our rack-scale plug-and-play total solutions, especially with liquid cooling DLC, ensure optimal system performance while saving energy cost up to 40% at data center scale, delivering much more value to customers.

【看圖說故事】除了重申其競爭優勢外,SMCI 表示若不是受到一些關鍵零組件短缺的限制,營收還可成長更多。展望未來,規模經濟效益可望不斷擴大,將帶動淨利率向上提升,馬來西亞工廠若投入運營,預計還有進一步提升的空間。

在 FY24Q3 的成就:

被納入 S&P 500 指數。

調整後 EPS 為 $6.65 ,遠高於去年同期的 $1.63 美元,年增超過 308%。

營收年增 200% 至 38.5 億,高於官方展望,主要歸功於對 AI 平台的需求增加,因為許多客戶想要更快地導入最新的 AI 平台,驅動這波成長。

SMCI 提供優化的 AI 解決方案 ,這些方案經過精心設計,可以快速部署,並提供優於競爭對手的上市時間,

Building Block Solutions:像積木一樣組合在一起的 AI 解決方案,客戶可以根據自身需求選擇所需的元件,快速組裝成完整的系統

rack-scale plug-and-play:可以在機架上直接安裝的即插即用式解決方案,可以更快速、更方便地部署。

液冷 DLC :為客戶節省高達 40% 的能源成本,並提升系統效能,為客戶帶來更大的價值。

【Charles Liang】

We are leading the AI revolution by deploying NVIDIA HGX H100 SuperCluster solutions to our customers, housed in our new 100 kilowatt racks, with 2 times to 3 times higher power density than traditional racks from others. At NVIDIA GTC last month, we unveiled our next-generation Blackwell products, including the GB200 NVL72 solution. To further grow our AI portfolio, we are now strongly focused on developing new generative AI and inference-optimized systems based on the upcoming next-generation NVIDIA H200, B100, B200, GH200 and GB200 GPUs as well as Intel Gaudi2, Gaudi3 and AMD MI300X and MI300A GPUs. Most of them support both air cooling and DLC cooling.

As Supermicro is transitioning to our next generation of X14 and H14 product lines featuring the industry's broadest SKUs of Intel XEON 6 processor-based and AMD Turin-based platforms, we are fully ready for high volume production and offer early online access for testing and validation through our JumpStart cloud service. Meanwhile, our X14 and H14 storage solutions are addressing the specific requirements of accelerated AI data pipelines with partners like Weka, VAST Data, and many others.

The rapid growth of our business is raising the complexity to scale our capacity. Our production team are making aggressive progress on retrofitting the new Silicon Valley facilities and scaling up our Taiwan and Malaysia factories. We have secured the parts and acquired additional warehouses for our next phase of enterprise and data center businesses. We are currently on track to produce over 2,000 liquid cooling DLC racks per month of AI servers with volumes steadily increasing. Each DLC rack supports up to 100 kilowatt or even 120 kilowatt.

At this moment, we are focusing on delivering more than 1,000 racks of NVIDIA HGX AI supercomputers, each rack supports 64 piece H100, H200 or B200 GPUs, with the latest DLC liquid cooling technology to three industry-leading customers, from April to June of this quarter. These three deployments will be among the world's largest DLC liquid-cooled AI clouds, potentially saving our customers up to 40% of energy costs compared to standard air-cooled deployments by our competition. Special thank you to NVIDIA and our close technology partners for this fantastic collaboration. I believe this is just the beginning of our long-term high volume DLC liquid cooling mission. Green Computing can be free with a big bonus. Let's go for Green!

In summary, we had a strong quarter with more to come. Supermicro is uniquely capable of delivering new technologies to market faster with our integrated rack-scale plug-and-play solutions, in-house engineering, building block architecture, and green computing DNA. With a robust pipeline of new products in calendar year 2024, we're confident fiscal Q4 revenue will be in the range of $5.1 billion to $5.5 billion. This will raise our fiscal revenue guidance to $14.7 billion to $15.1 billion, an increase to our recent fiscal 2024 guide. We continue to win market share and remain committed to executing our growth plans across all verticals. This remains truly the most exciting time yet for Supermicro, and I believe this strong year-over-year growth will continue in our fiscal 2025, especially with our new, leading and ready-to-ship DLC liquid cooling rack-scale plug-and-play solutions and technologies.

Before passing the call to David Weigand, our Chief Financial Officer, I want to thank you again to our partners, our customers, our employees, and our shareholders for your strong support. David?

【看圖說故事】SMCI 強調在 AI 領域的領導地位,以及對產品創新、生產能力擴展、綠色運算的承諾,並對未來的成長極具信心。尤其是 FY24Q4 將出貨 超過 1,000 個100 千瓦的機櫃,讓他的營收從 FY24Q3 的 38.5 億美元的水準一舉跳升至 50 億美元以上,年化營收成功突破來到 200 億美元,且接下來的 FY25Q1 與 FY25Q2 的營收將持續維持季增態勢!

透過提供 NVIDIA HGX H100 SuperCluster 解決方案,100 千瓦的新機架比傳統機架的功率密度高出 2 到 3 倍,為客戶提供更強大的運算能力。積極開發全新生成式 AI 和推理優化系統,涵蓋基於 NVIDIA H200、B100、B200、GH200 和 GB200 以及 Intel Gaudi2、Gaudi3 和 AMD MI300X 和 MI300A 等處理器,普遍都支持風冷和液冷技術,為客戶提供更多選擇。

正轉型至下一代 X14 和 H14 產品線,提供基於 Intel Xeon 6 和 AMD Turin 的平台,SKU 種類更豐富,可滿足 AI 的特定需求,已做好大量生產的準備。

業務快速成長,帶來擴展產能的挑戰,正積極改造矽谷的新設施,並擴大台灣和馬來西亞工廠的規模,同時已確保零組件供應,並購置額外的倉庫,以滿足下一階段得發展,目前正朝向每月生產超過 2,000 個液冷 DLC 機架的路上,每個機架支援高達 100 千瓦甚至 120 千瓦的功率。

目前正在為三個大客戶提供超過 1,000 個機櫃的 NVIDIA HGX AI 超級電腦,每個機架支援 64 個 H100、H200 或 B200 GPU,並採用最新的 DLC 液冷技術。這些部署將成為全球最大的 DLC 液冷 AI 雲端平台之一,與傳統風冷方案相比,可為客戶節省高達 40% 的能源成本。對 DLC 液冷技術的長期發展充滿信心,認為綠色運算可以成為一種免費且具有額外優勢的選擇。

預計 FY24Q4 營收將為 51 - 55 億,FY24 營收預期提高至 147 -151 億。將繼續在各個垂直市場爭取市占,並執行其成長計畫。相信其在 FY25 將持續強勁的年成長,特別是其新的 DLC 液冷機架規模的即插即用解決方案和技術。

【Charles Liang】

Supermicro is at the forefront of the current AI revolution. These strong results reflect the continued demand for our rack-scale plug-and-play total AI solutions. We continue to face some supply chain challenges due to new products that require new key components, especially, DLC-related components, and believe this situation will gradually improve in the coming quarters.

To sustain this rapid growth, we are making significant investments in production, operation, management software, cloud features and customer service to further increase our customer base and bring more value to them. To support this scale-up, we raised an additional $3.28 billion through a convertible note and secondary equity offering in the quarter. We like to support strong short- and long-term growth with minimal equity dilution. Overall, I remain optimistic that AI growth will continue for many quarters, if not many years to come.

We have long recognized that AI is accelerating the need for liquid cooling, and we have invested heavily into high quality, optimized direct liquid cooling, DLC, solutions for high-end CSPs and NCPs. With GPUs reaching 700 watts and soon more than 1,000 watts, efficiently managing the heat from these AI systems has become critical for many customers, especially at the new data centers. I am pleased to announce that our new DLC liquid cooling building blocks and rack scale total solution technology are finally ready for high volume production. With our DLC liquid cooling technology, customers can reduce their expense on cooling [expense] (ph), saving data center space, and allocate a greater portion of their finite power resources to computing instead of cooling, which aligns with our green computing DNA.

【看圖說故事】SMCI 對 AI 的發展持樂觀態度,認為 AI 的成長將持續數個季度,甚至數年,而全新的 DLC 解決方案技術已經可批量生產!

業績反映市場對其機架級別的即插即用 AI 解決方案的需求。面臨供應鏈挑戰,尤其是與 DLC 相關的零組件,這些零組件是新產品的重要組成部分,預期此情況將在未來幾季逐漸改善。

為維持快速成長,正在對生產、運營、管理軟體、雲端功能和客戶服務進行重大投資,以進一步擴大客戶群,因此發行可轉債和新股募資了 32.8 億美元,希望以最小的股權稀釋來支持強勁的長短期成長。

AI 正在加速對液體冷卻的需求,SMCI 早已大量投資於直接液體冷卻 (DLC) 解決方案,以滿足高端 CSP 和 NCP 的需求。GPU 將很快就會超過 1,000 瓦,SMCI 的新 DLC 液冷構建模塊和機架級別的整體解決方案技術,已準備好進行大規模生產,該技術可幫助客戶降低冷卻成本,節省資料中心的空間,並將更多有限的電力資源分配給運算,而非將電力用於冷卻。

【David Weigand】

Fiscal Q3 2024 revenues were $3.85 billion, up 200% year-over-year and 5% quarter-over-quarter. Q3 growth was again led by AI GPU platforms which represented more than 50% of revenues with AI GPU customers in both the enterprise and cloud service provider markets. We expect strong growth in Q4 as the supply chain continues to improve with new air-cooled and liquid-cooled customer design wins.

During Q3, we recorded $1.88 billion in the enterprise/channel vertical, representing 49% of revenues versus 40% last quarter, up 190% year-over-year and 26% quarter-over-quarter, driven by industry recognition of our solution price-performance metrics and reliability. The OEM appliance and large data center vertical revenues were $1.94 billion, representing 50% of Q3 revenues versus 59% in the last quarter, up 222% year-over-year and down 10% quarter-over-quarter. One existing CSP/large data center customer represented 21% of Q3 revenues and one existing enterprise/channel customer represented 17% of revenues. Emerging 5G/Telco/Edge/IoT revenues were $37 million or 1% of Q3 revenues.

Server and Storage Systems comprised 96% of Q3 revenue and Subsystems and Accessories represented 4%. ASPs increased on a year-over-year and quarter-over-quarter basis.

By geography, U.S. represented 70% of Q3 revenues, Asia 20%, Europe 7%, and Rest of World 3%. On a year-over-year basis, U.S. revenues increased 242%, Asia increased 257%, Europe increased 30%, and Rest of World increased 87%. On a quarter-over-quarter basis, U.S. revenues increased 3%, Asia increased 17%, Europe increased 3%, and Rest of World decreased 11%.

【看圖說故事】FY24Q3 的財務表現,營收成長由 AI GPU 平台引領,佔總收入的 50% 以上。有兩個最重要的客戶,占比分別達到 17% 與 21%;而由應收帳款推估, FY24Q3 獲得一名新客戶,營收占比可望超過 10%;

營收:為 38.5 億,年增 200%,季增 5%,受惠平均銷售價格上漲。由 AI GPU 平台引領,佔總收入的 50% 以上,AI GPU 客戶涵蓋企業和雲端服務提供商市場。隨供應鏈的持續改善以及新的風冷和液冷客戶設計的成功,看好 FY24Q4 將維持強勁成長。

伺服器和存儲系統:佔比 96%

子系統和配件:佔比 4%

垂直領域:

企業/通路:營收達 18.8 億,占比達 49%,前季為 40%,年增 190%,季增 26%;

一個既有客戶占總營收比重達 17%;

OEM 設備和大型資料中心:營收達 19.4 億,營收占比達 50%,前季為 59%,年增 222%,季減 10%;

一個既有客戶占總營收比重達 21%;

地區:

美國:佔比 70%,年增 242%,季增 3%;

亞洲:佔比 20%,年增 257%,季增 17%;

歐洲:佔比 7%,年增 30%,季增 3%;

世界其他地區:佔 3%,年增 87%,季減 11%;

【David Weigand】

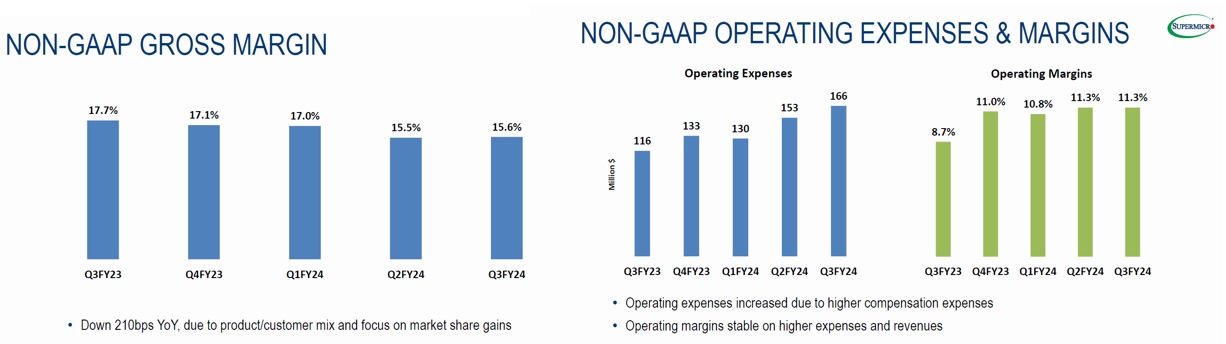

The Q3 non-GAAP gross margin was 15.6%, up slightly quarter-over-quarter from 15.5% as we continued to focus on winning strategic new designs, gaining market share and improving manufacturing efficiencies.

Q3 operating expenses on a GAAP basis increased by 14% quarter-over-quarter and 72% year-over-year to $219 million driven by higher compensation expenses and headcount. On a non-GAAP basis, operating expenses increased 8% quarter-over-quarter and 43% year-over-year to $166 million. Q3 non-GAAP operating margin was 11.3%, which was in-line with Q2 levels.

Other income and expense for Q3 was $3.8 million, consisting of $6 million in interest expense and a gain of $10 million principally from foreign exchange. Interest expenses decreased sequentially as we paid down short-term bank credit facilities.

The GAAP tax rate was negative 5.2% resulting in a tax benefit of $20 million for Q3. The non-GAAP tax rate for Q3 was 6% resulting in Q3 tax expense of $27 million. GAAP and non-GAAP tax rates were lower due to the impact of higher R&D tax credits and tax benefits from employee stock grants exercised.

Q3 GAAP diluted EPS of $6.56 and Q3 non-GAAP diluted EPS of $6.65 exceeded the high end of guidance through record revenues, stable gross margins and operating margins and lower tax rates.

The GAAP share count increased from 58.1 million to 61.4 million and the non-GAAP share count increased sequentially from 59 million to 62 million shares as a result of the two stock offerings and, to a lesser extent, the convertible bond offering.

Cash flow used in operations for Q3 was $1.5 billion compared to cash flow usage of $595 million during the previous quarter as we grew inventory and accounts receivable for higher levels of business. Cash flows from strong profitability was offset by higher inventory, a large portion of which was received late in Q3, and higher accounts receivable from increasing revenues.

Our Q3 closing inventory was $4.1 billion, which increased by 67% quarter-over-quarter from $2.5 billion in Q2 due to the purchase of key components. Capex was $93 million for Q3 resulting in negative free cash flow of $1.6 billion for the quarter.

【看圖說故事】營收創新高,帶動整體的獲利成長。毛利率和營運利益率表現穩定,亦顯示在成本控制和營運效率方面的表現不錯;SMCI 本季的獲利能力強勁,但由於庫存增加和應收帳款增加,導致其營運現金流量為負,雖代表正在積極投資未來成長,但需要密切關注庫存週轉率和應收帳款的管理,以確保這些投資最終能轉化為正面的現金流,文章後面會進一步討論;另外,發行股票和可轉換債券,獲得更多資金可以擴大營運規模,但也稀釋現有股東的持股比例,不利股價;

稀釋後 EPS:為 6.56 美元;

調整後稀釋後EPS:為 6.65 美元,超過展望上限,主要來自於營收創新高、穩定的毛利率、營業利潤率,以及較低的稅率;

調整後毛利率:為 15.6%,前季為 15.5% ,因為持續專注於贏得戰略性的新設計、獲得市占和提高生產效率;

營業費用:季增 14%,年增 72%,達到 2.19 億,因更高的薪酬費用和員工人數增加;調整後營業費用:季增 8%,年增 43%,達到 1.66 億;

調整後營業利益率:為 11.3%,與前季持平;

其他收入和支出:為 380 萬,包括 600 萬利息支出和 1000 萬來自外匯的收入;因償還短期銀行信貸額度,利息支出呈現季減;

稅率:為負 5.2%,因獲得 2000 萬的稅賦優惠;調整後稅率為 6%,因稅賦支出為 2700 萬;主要是因為更高的研發稅收抵免和員工股票期權行使帶來的稅賦優惠的影響,令稅率均有所降低;

股數:進行 2 次股票發行與 1 次可轉換債券發行;

普通股股數:自 5810 萬股增至 6140 萬股;

調整後股數:自 5900 萬股季增 300 萬股至 6200 萬股;

自由現金流:為負 16 億美元;

運營現金流:為 -15 億,前季為 5.95 億,因擴大營運而增加庫存和應收帳款;庫存季增 67% 至 41 億,因採購關鍵零組件;

資本支出:為 9300 萬美元,正在積極投資擴張;

【David Weigand】

During the quarter, we raised $1.55 billion from a 0% coupon five-year convertible bond offering due in 2029, net of underwriting discounts and offering expenses. We also raised approximately $1.73 billion in net proceeds from the sale of 2 million shares at a price of $875 per share. The proceeds from these transactions will be used to strengthen our working capital, enable continued investments in R&D and expand global capacity to fulfill strong demand for our leading platforms.

The closing balance sheet cash position was $2.1 billion, while bank and convertible note debt was $1.9 billion resulting in a net cash position of $252 million versus a net cash position of $350 million last quarter.

【看圖說故事】募資,以增強營運資金,持續投資於研發,並擴大全球產能;可轉換債券的優勢是短時間之內不會稀釋股權,而且零息債也不會增加利息支出,相對於發新股籌資,短期內對於股價的負面影響較小。

可轉換債券:發行 2029 年到期、 零票息的可轉換債券,籌資 15.5 億;

現金增資:以每股 $875 的價格出售 200 萬股,籌資約 17.3 億;

淨現金:為 2.52 億,前季為 3.5 億;

現金:為 21 億;

銀行和可轉換債券負債:為 19 億;

【David Weigand】

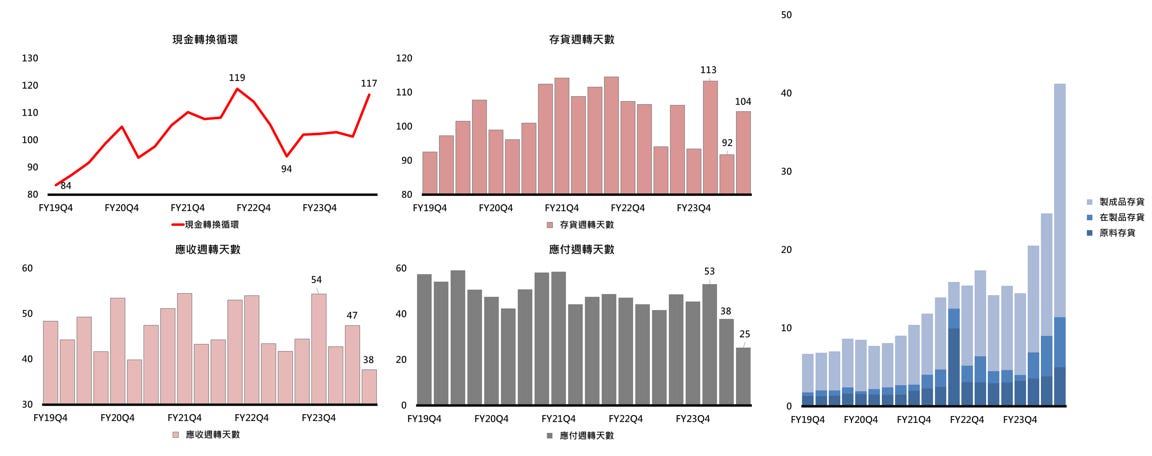

Turning to the balance sheet and working capital metrics compared to last quarter, the Q3 cash conversion cycle was 96 days versus 61 days in Q2. Days of inventory increased by 25 days to 92 days compared to the prior quarter of 67 days due to key component purchases for higher expected Q4 revenues. Days sales outstanding increased by 8 days quarter-over-quarter to 37 days while Days Payables Outstanding decreased by two days to 33 days.

【看圖說故事】儘管庫存天數大增,但因為關鍵零組件是在季底才入倉,加上即將出貨,對整體營運的影響不大。

現金轉換週期:為 96 天,前季為 61 天;

庫存天數:比前季的 67 天增加 25 天 至 92 天,為 FY24Q4 準備而購買關鍵零組件;

應收帳款天數:季增 8 天至 37 天;

應付帳款天數:季減 2 天至 33 天;

【David Weigand】

Now turning to the outlook for Q4, we expect strong growth as the supply chain continues to improve with new air-cooled and liquid-cooled customer design wins. For the fourth quarter of fiscal 2024 ending June 30, 2024, we expect net sales in the range of $5.1 billion to $5.5 billion, GAAP diluted net income per share of $7.20 to $8.05 and non-GAAP diluted net income per share of $7.62 to $8.42.

We expect gross margins to be down sequentially as we focus on driving strategic market share gains.

GAAP operating expenses are expected to be approximately $226 million and include $55 million in stock-based compensation expenses that are not included in non-GAAP operating expenses.

The outlook for Q4 of fiscal year 2024 fully diluted GAAP EPS includes approximately $30 million in expected stock-based compensation expenses, net of tax effects of $28 million, which are excluded from non-GAAP diluted net income per common share.

We expect other income and expenses, including interest expense, to be a net expense of approximately $8 million.

The company's projections for Q4 GAAP and non-GAAP diluted net income per common share assume a GAAP tax rate of minus 2.9%, a non-GAAP tax rate of 2.6%, and a fully diluted share count of 64.8 million for GAAP and 65.3 million shares for non-GAAP. We expect CapEx for Q4 to be in the range of $55 million to $65 million.

For fiscal year 2024 ending June 30, 2024, we are raising our guidance for revenues from a range of $14.3 billion to $14.7 billion to a range of $14.7 billion to $15.1 billion, and establishing guidance for GAAP net income per diluted share of $21.61 to $22.46, and non-GAAP net income per diluted share of $23.29 to $24.09.

Our projections for GAAP and non-GAAP net income per diluted share assume a tax rate of approximately 3.6% and 9.2%, respectively, and a fully diluted share count of 61.2 million shares for GAAP and fully diluted share count of 61.8 million shares for non-GAAP. The outlook for fiscal year 2024 GAAP net income per diluted share includes approximately $116 million in expected stock-based compensation, net of related tax effects of $98 million that are excluded from non-GAAP net income per diluted share.

【看圖說故事】 看好 FY24Q4 仍會有強勁成長,因為供應鏈隨氣冷和液冷新客戶設計的贏得而將持續改善;不過,毛利率或因積極搶市而再下滑,SMCI 雖有信心可以維持在 15%-17% 的區間;分析師開始擔心,為什麼 SMCI 可以比同業先拿到 GPU,毛利率還會繼續下滑?是不是市場對 GPU 的需求不再?還是同業終於推出更好的產品?

FY24Q4

營收:估 51 - 55 億;

毛利率:估將季減;因為專注於推動戰略性的市占成長。

營業費用:估 2.26 億美元,包括 5500 萬美元的基於股票的薪酬費用。

稀釋後EPS:估 7.20 - 8.05 美元;假設稅率為 3.6% ,股數為 6120 萬股,並包括約 1.16 億美元的基於股票的薪酬,扣除 9800 萬美元的相關稅收影響

調整後稀釋後 EPS:估 7.62 - 8.42 美元;假設稅率為 9.2%,股數為 6180 萬股;

FY24 展望

營收:從 143 -147 億提高到 147 - 151 億美元;

稀釋後 EPS :21.61 - 22.46 美元;

調整後稀釋後EPS :23.29 - 24.09 美元;

Ruplu Bhattacharya

Hi, thank you for taking my questions, and congrats on the strong guidance. I have two questions. First, I wanted to ask a question on liquid cooling. Do you design most of the components for liquid cooling racks in-house? And as such, do you think you would be able to charge more for liquid-cooled racks? And can this be accretive to gross margins?

【Charles Liang】

Yes, very good question. Yes, we design lots of key components for, DLC, liquid cooling system, because we care quality, maintenance, and also time to market. So, we design lots of key components while we leverage third-party components as well. So, it's a combination. And, yes, I mean, liquid cooling, we try to charge customer with a minimum premium, and customer can save kind of air-conditioned equipment cost because cool down my liquid, right? So, at the same time, customer will safe lots of TCO, up to 40% of energy cost. That's why we try to promote a slogan, "green computing can be free with big bonus." Customer pay a very minimal premium, but they save up to 40% of energy cost. So, I believe a lot of customer will go for that direction. And, indeed, we already have a handful of customer have big order. That's why this quarter alone -- I mean, June quarter, we are preparing more than 1,000 liquid cooling rack for those early bird. And I believe the demand will continue to grow very strong.

【看圖說故事】SMCI 強調液冷技術在資料中心應用的優勢,包括成本效益、能源效率和市場需求,根據有限資訊來推測,儘管液冷機櫃是新技術,需求也很高, SMCI 應該還是沒有大幅提高售價,只對液冷機櫃收取最低限度的溢價,而新技術也可能使其生產成本大幅增加,也會壓縮到毛利率,然就長遠來看,如果市場需求持續強勁,或者是達到規模經濟, SMCI 仍可以透過銷售大量的液冷機櫃獲取利潤。

Q. 貴是否自行設計大部分液冷機架的組件?液冷機架是否可以收取更高的價格,從而提高毛利率?

A. SMCI 設計許多液冷系統的關鍵組件,以確保質量、維護和上市時間,但也利用了第三方組件,只對收取最低限度的溢價;客戶可以節省空調設備成本,因為液體冷卻系統可以降低溫度,節省高達 40% 的能源成本,相信可以吸引到很多客戶會選擇液冷技術,也已收到一些大訂單,僅 FY24Q4 就準備超過 1000 個液冷機櫃,看好需求將繼續強勁成長。

Samik Chatterjee

Yeah. Hi. Thanks for taking my question. I guess in the press release, Charles, you mentioned the visibility into share gains as the new solutions ramp. And I was curious if you can sort of give us a bit more color there in terms of when you're thinking about share gains, are these relative to the next-generation GB200 product with NVIDIA? And is this more in relation with sort of hyperscalers? Are you expanding the number of hyperscalers that you are engaged with as you move to these new solutions? Just any more color in terms of the visibility around these share gains? Where is that coming from? And is that more in relation to the next product generation from NVIDIA? Thank you.

【Charles Liang】

Okay. Thank you. I mean, yes, we continue to gain market share, especially our rack-scale plug-and-play solution that reduce customers' lead time and also reduce customers' time to online. With our rack-scale plug-and-play, customer able to put the system -- deploy the system online in next day or next few days instead of the next few weeks. So, time to online saving is a big advantage to customer.

At the same time, the liquid cooling, they help customer save energy power. So, customer can allocate, relocate the energy power to power more computing equipment instead of waste of power for air cool. So, same money, that benefit lots of leading customer, and also rack-scale plug-and-play that make customer time to online.

So, we continue to gain more new customer. While our old customer continue to grow, started to grow faster with our beta offering. So, GB200 [indiscernible] right? GB200, each rack will be around 100 kilowatt. So, lots of customer like that. And we help them build their liquid cooling system and optimize their data center for liquid cooling. So, we are growing customer base strongly now.

【看圖說故事】SMCI 的市佔成長不僅與 NVIDIA GB200 有關,也與其自身的技術創新和解決方案有關,並自信地表示正在持續獲得市占,不僅贏得新客戶,既有客戶也持續增加採購;目前正在積極拓展客戶群,包括超大規模客戶,從文章後面的客戶營收占比與應收帳款的討論可以看到, SMCI 至少在 FY24Q3 新增了一名營收占比超過 10% 的客戶,而 FY24Q2 也有新增一名;

Q. 市占的成長,是否與 NVIDIA 的下一代產品 GB200 有關?是否與超大規模客戶有關?是否在拓展與其合作的超大規模客戶數量?可以提供更多細節嗎?

A. 獲得市占的主要原因包含機架級別的即插即用解決方案,因為縮短客戶的交付週期和上線時間而獲得青睞;液冷技術 幫助客戶節省能源、提高效率,而 GB200 產品也因為高功率與液冷設計,都吸引大量客戶。

Michael Ng

Hey, good afternoon. Thank you very much for the question. I wanted to ask about gross margins. Strong gross margins for the quarter. I know you're guiding to a sequential decline in gross margins. If our math is right, I think that implies 13.5% to 14% gross margins for the June quarter -- sorry, for the June quarter. Is that the right way to think about gross margins on a go-forward basis? Do you still feel comfortable with the prior 14% to 17% long-term gross margins? And any comments just around AI server gross margins in general? And if there are any ancillary services and support that can help improve the margins on just the product sales? Thank you very much.

【David Weigand】

Yeah. So, our target is still 14% to 17%. If you look at our guide for Q3, we actually guided slightly down and we ended up slightly up. And so, it's very hard to guide exactly on the margins. There is a range, and in fact, I think the guide inside of -- inside the models last time was even more conservative. So, I would say, we build conservative -- we build conservatively and then seek to overachieve. So, I think, if you look at our guide for revenue and for OpEx, you'll be able to determine our guide there. But our target is definitely to stay in the 14% to 17% range.

【看圖說故事】儘管下一季的毛利率預計會下降,但 SMCI 仍然有信心長期毛利率可以維持在 14% 到 17% 的目標範圍內,他們採取保守的財務預測策略,並致力於超越目標。

Q. 根據推算,下一季將降至 13.5% 到 14% 嗎?是否仍然認為長期毛利率可維持在 14% 到 17% 的水準? 以及是否有任何服務可以幫助提高產品銷售的毛利率?

A. 目標毛利率仍然維持 14% 到 17%, FY24Q3 的結果是優於先前的展望的,而預測毛利率也很難做到準確,所以 SMCI 財務預測通常比較保守,先保守預估,然後再努力超越目標,SMCI 的目標絕對是保持在 14% 到 17% 的範圍內。

Aaron Rakers

Yeah. Thanks for taking the question. I'll try and slip in two here, if I can. So, I guess, one of the just kind of housekeeping questions is a very significant increase in inventory this quarter. I know you said it came in towards the end of the quarter.

How do we think about the trajectory of inventory as the supply comes on? Do you expect inventory to stay at this level? Do you expect it to start to come down? I'm just kind of curious to how we think that flow through kind of looks as you take on more supply?

And then just a quick housekeeping thing too is that, the 21% customer you referenced in the prepared remarks, is that the same large customer you had last quarter, or how has that evolved? Thank you.

【Charles Liang】

Two reasons we had to increase inventory. One is because Q4, I mean, June quarter, we will have a strong revenue growth. Second reason, because we're preparing for high volume liquid cooling. Again, we have more than 1,000 of 100 kilowatt liquid cooling rack we had to ship to customer in Q4. And liquid cooling, as you know, is pretty new. So, we had to prepare enough inventory, so that we can deliver liquid cooling rack-scale product to customer on time or with minimum lead time. So, both factor, indeed, is a positive factor though. With our economic of scale continue to grow, indeed, our inventory average day, indeed, will slightly improve.

【David Weigand】

Yeah. So, Aaron, my take on that is I hope that our inventory continues to grow because that means there's a reason behind it. So, it's -- and it's tied to sales.

So, to your second question, the 21% customer was, the same as last quarter. And I want you to -- I wanted to let you know that, in the Q, we're going to be moving to customer A, customer B, customer C, because as we add more customers, we'll try to make it easier to make those distinguishments.

【看圖說故事】SMCI 預期 FY24Q4 強勁成長,因此積極備貨,並正在為大規模液冷技術做準備,願意投入資源發展相關產品;其客戶群正在擴大,改用客戶 A、客戶 B、客戶 C 來區分客戶,暗示客戶數量正在增加,且不再集中於少數幾個大客戶,隨著客戶群體擴大和產品銷售增長,規模經濟效益有機會進一步提升,應有助於降低生產成本,提高毛利率。應持續觀察實際情況的發展,例如,市場需求變化、新技術發展進度、競爭對手動向等因素都可能影響其發展。

Q. 因為供應在季末到貨,導致本季的庫存大幅增加,但隨著供應增加,庫存的未來走向會如何?預期庫存會維持在這個水準嗎?還是預期會開始下降?隨著獲得更多供應,庫存的流動情況會是如何?而 21% 的大客戶是否與上季提到的同一個大客戶相同,還是情況有所變化?

A. SMCI 必須增加庫存有兩個原因。第一個原因是因為 FY24Q4 的營收會強勁增長。第二個是因為我們正在為大規模液冷做準備,FY24Q4 向客戶交付超過 1000 個 100 千瓦的液冷機櫃。液冷技術還很新,所以必須準備充足的庫存,才能夠準時或以最短的交付週期將液冷機櫃規模的產品交付給客戶。這兩個因素都是積極的因素,隨著規模經濟持續成長,平均庫存天數確實會略有改善,我們希望庫存繼續城長,因為這是與銷售額掛鉤的。

21% 的客戶與上季的相同,財報中將改用客戶 A、客戶 B、客戶 C 來稱呼,因為客戶越來越多,這樣較容易區分。

George Wang

Hey, guys. Congrats on the strong June guide. I'd like to put in two parts. Quickly, just not asking for specific guidance for FY '25 or the September, December quarter, but any sort of high-level kind of color you can provide just to think about how to model the September, December and also the FY '25? And also kind of related, kind of can you parse out kind of utilization in the March quarter? And also kind of what's the expected utilization kind of cadence for the next few quarters?

【Charles Liang】

Yeah. As you know, we have a lot of new product coming soon, right, to support NVIDIA, H200, B100, B200, GB200, and AMD MI300 and Intel Gaudi2, Gaudi3. So, we have a lot of new product already, and plus, liquid cooling, DLC, we are ready to ship high volume product. So for sure, I mean, calendar -- I mean, fiscal year '25, I mean, for September, December quarter, we will be -- we will have a strong growth. And I believe this strong growth will continue for many quarter to come if not many years. I believe it will be many years.

【看圖說故事】SMCI 雖然並未直接回答關於產能利用率的具體問題,但對未來成長的樂觀預期來看,SMCI 的產能利用率將會隨著市場需求的增加而持續提升,他們積極布局新產品和技術,並有信心將在未來幾年內保持強勁成長;而這樣的信心不僅對於 SMCI 本身很重要,對於整個 AI 產業的前景很重要,因為未來幾個季度若能持續季增,再搭配規模經濟而改善獲利能力,SMCI 就很有機會維繫著本身的估值,而其自信心主要來自於市場對於 NVDA 產品的需求,影響到整個 AI 產業的趨勢;不過另一方面也要注意,若是成長率開始下降,恐將大幅衝擊投資信心。

Q. 不需要具體的 FY25 全年展望,或是 FY25Q1 與 FY25Q2 的財務預測,但能否提供較深入的看法,以便建立模型?能否分析 FY24Q3 產能利用率?以及未來幾個季度的產能利用率趨勢?

A. SMCI 將推出許多新產品,以支持 NVIDIA 的 H200、B100、B200、GB200,以及 AMD 的 MI300 和 Intel 的 Gaudi2、Gaudi3,再加上液冷技術 DLC,已經準備好大量出貨。所以,FY25、FY25Q1 與 FY25Q2 都將毫無疑問地大幅成長,不僅相信這種强勁成長將持續許多季度,也相信會持續許多年。

Ananda Baruah

Yeah. Thanks guys for taking the question. Really appreciate it. And Charles, let me maybe, the remarks you made a moment ago about the strong ongoing growth, does that -- could that mean that you could also grow sequentially from this point forward for a little bit, just given the market share gain opportunities, the components coming online that you talked about in the new products? Any context on the way to think about sequential growth sort of in the coming quarters would be helpful as well. Thanks.

【Charles Liang】

Yeah. As you know, traditionally, in last 10 years, right, I mean, September quarter and March quarter always our soft quarter. But now with AI demand growing so strong, so we basically are able to grow sequentially. So, although, March and September still a little bit weak, but, basically, because of strong AI growth and our market share growing, so the sequential growth will become normal. And, basically, I mean, we have even better technologies than before ever, and now economies of scale become much bigger. Malaysia campus, production will be ready by end of this calendar year. So, we see lots of positive factor to grow our business.

【看圖說故事】在 AI 需求強勁成長、市佔率擴大、技術提升以及規模經濟效益提升等多重因素的推動下,SMCI 將打破過去的季節性規律,有信心將實現持續的季增走勢。

Q. 市占率持續增加、新產品上線和零組件供應改善,季度成長可以維持多久?一段時間?能否提供一些關於未來幾個季度季增率的訊息?

A. 傳統上,Q1 與 Q3 通常是淡季。但隨 AI 需求的強勁成長,FY25Q1 與 FY25Q3 將呈現季增。雖然仍稍微疲軟,但AI 的強勁成長,加上市占不斷增加,季度環比增長將會成為常態。基本上,SMCI現在擁有比以往任何時候都更好的技術,而且規模經濟也變得更大。馬來西亞廠區的生產將在今年年底準備就緒。所以有非常多的積極因素將促進業務成長。

Jon Tanwanteng

Hi. Thank you for taking my questions. I was wondering if you could talk a little bit more to the gross margin and if you expect them to go structurally higher at some point in the near future, in the coming quarters. Especially if Malaysia ramps, you get economies of scale there as you transition to GPU products and you add more liquid cooling. Is there a point where that starts to revert higher? Or do you expect it to remain at a relatively constant level for the foreseeable future?

【Charles Liang】

Again, the AI platform is getting popular, right? So, there are more and more competitor as well. So, we will try to keep a balance. To grow market share, we may, sometimes, some deal, we may have to be a little bit more aggressive in pricing. But, overall, we try to keep a balance. David, you may add something.

【David Weigand】

Yeah. And also, I agree with your point that Malaysia will also offer some opportunity to us. And we're also at a transition time when there's a lot of new -- we have a lot of new platforms that are coming out and the customers are highly anticipating. And those platforms are built on some emerging technologies that from many different areas. And we -- Supermicro's strength again is its fast time to market, and we expect with these -- with the emerging technologies and our new platforms and our liquid cooling to be first out there with very compelling solutions. So, we think those things are all going to be helping our margins.

【看圖說故事】SMCI 並沒有明確表示毛利率一定會提升,而是強調他們會努力保持平衡。儘管快速上市的競爭優勢,加上馬來西亞廠區投產,以及新平台和液冷技術的應用等技術優勢,有助於在市場競爭中保持領先,並提供提升毛利率的機會 ,但是 AI 市場的快速,尤其是 NVDA 供應趨於順暢,更進一步放大市場競爭,使得毛利率預測變得更加困難,因此需要非常努力地在價格和毛利率之間取得平衡。

Q. 是否預計在未來幾個季度,毛利率會出現結構性上升?特別是馬來西亞廠順利擴產,以及轉型到 GPU 產品、並增加更多液冷技術,在獲得規模經濟效益是否會出現毛利率開始反彈的轉折點?或是在可預見的未來毛利率仍會保持在相對穩定的水平?

A. 隨 AI 正變得越來越受歡迎,競爭對手也越來越多,SMCI 將嘗試保持平衡。為了提升市場佔有率,某些交易將採取更積極的定價策略,但整體將盡力保持平衡;馬來西亞廠將提供一些機會,目前這個轉型期將推出很多備受客戶期待的新平台,這些平台建立在不同領域的新興技術之上,SMCI 的優勢在於上市速度,可以比同業更快推出極具競爭力的解決方案,最終將有助於提升獲利率。

Mehdi Hosseini

Yes, thanks for taking the question. A couple for me. Regarding the channel customer, the 17% of the customer, have you ever had the channel customer that big? I believe in the past you've talked about the 21 -- 20%-plus customer, but I think this is new. Can you clarify this?

【David Weigand】

So, this is an existing customer and we actually had a higher customer back in 2022, Mehdi, but I think they were around [22%] (ph). But this is still a really good customer, really good opportunity.

Mehdi Hosseini

Okay. Great. And then, one question for you David on the cash flow. Actually, there was a -- I believe there are two items. There is a $110 million of cash burn in operation and then there was also a non-current asset. Am I missing something here? These two items were big items that had an impact to overall cash flow. Is that correct?

【David Weigand】

Sure. We had a number of things that impacted us. I think in non-current assets, we had deferred taxes grew by quite a bit this year -- or this quarter, and so that was something unusual. And then, let's see, I think those are -- I think that's the only unusual item, was a deferred tax grew a lot and that's what lowered our tax rate -- our quarterly tax rate as well.

【看圖說故事】分析師詢問 SMCI 是否獲得新的通路客戶 (營收占比 17%),雖然很可惜不是在 FY24Q3 新增的,但實際上是在 FY24Q2 才有的新客戶 ( B 客戶),而且需求也滿強的;不過,從應收帳款的數字來看,FY24Q3 應新增一名 E 客戶 (應收占比 18.1%);

根據 FY24Q1-Q3 的財報推論,FY24Q1 僅一位客戶的營收占比超過 10% 需要申報 (25%,約為 5.3 億);但 FY24Q2 時則變成有兩位客戶,分別為 25.5% 與 10.4% (分別約為 9.35 億與3.81億),本季新增一位客戶; FY24Q3 時,A 客戶的營收占比自 25.5% 降至 21.2% (營收約為 8.16 億),B 客戶自 10.4% 增至 16.8%,這就是分析師問的通路客戶 (FY24Q2 獲得的新客戶),其營收約為 6.47 億;

另一方面,儘管應收帳款不完全等於營收,但值得注意的是,FY24Q3 有提到應收帳款中有一名 E 客戶,其占應收帳款的比重高達 18.1%,甚至高過於 B 客戶的 15.4%;在 FY24Q2 時沒有提到 E 客戶,推估可能是新客戶,或者是既有客戶增加採購量,推估其應收帳款應該有 3 億美元;

Q. 該通路客戶佔營收比重高達 17%,以前似乎沒有這麼大的通路客戶?這是新客戶嗎?營運現金流出 1.1 億美元,還有一項非流動資產,這兩項對整體現金流有很大影響?

A. 這是既有客戶,2022 年有一位比例更高的客戶,約佔 22%。在非流動資產方面,遞延稅款大幅增加,這是不尋常的。然後,讓我看看,我認為這些是——我認為這是唯一不尋常的項目,就是遞延稅款大幅增加,這也降低季度稅率。

Nehal Chokshi

Thank you, and congrats on a strong guide here. Talk about the guide here, inventory increased $1.5 billion Q-over-Q, and David, as you mentioned, you like to see inventory increase. I do too, because it's a strong indicator of things to come. And you've guided June quarter to increase by $1.6 billion Q-over-Q. If I do this math where I'm looking at the inventory at the quarter-end and then the four-quarter revenue, typically, it's around 60% to 70% of revenue. But with your March Q ending inventory and your current June Q guidance, that equates to about 85% of projected revenue. So, can you just explain what seems to be a little bit more usual inventory buildup given the revenue guidance range?

【David Weigand】

Sure, absolutely. That's a fair question. So, we actually got a substantial amount of inventory in the last week of the quarter, okay, which obviously we're not going to be able to ship. But we took in $700 million in the last week of the quarter. So that's not something that -- that's something that has to do with when inventory arrives. And so, we -- it hurts our cash flow. But you know what? It doesn't matter, because we need that inventory for Q4 shipments.

【Charles Liang】

Yeah. Again, two reasons, right? Q4, we will have a strong revenue. So, we had to prepare with Q4. And, also, I mean, liquid cooling, I mean, it's new. So, we had to prepare enough safety inventory for liquid cooling demand for June quarter and September quarter as well. So that's another reason why we have a slightly higher inventory now.

【David Weigand】

Yeah. And I want to add, Nehal, that that's exactly why we did capital raises, too, is to prepare for these Q4 shipments, and so that we could make those large purchases and we hope to continue that.

【看圖說故事】分析師關注庫存管理和未來營收預測,SMCI 解釋高庫存是因季底才收到零組件入庫,而會有這些庫存是為了滿足強勁的未來需求而做的準備,因此先前才需要向市場融資,SMCI 不斷暗示對未來持續成長的信心,並傳達出積極的信號,以打消市場投資疑慮。

Q. 庫存增加通常是未來營收成長的積極指標,但 FY24Q3 庫存增加 15 億美元,與 FY24Q4 的營收展望相比,FY24Q3 庫存 / FY24Q4 營收的比率高達 85%,遠高於一般的 60% 到 70%,為何會有如此高的庫存/營收比?

A. 這與庫存到貨時間有關,因為是在 FY24Q3 的最後一周收到 7 億美元的庫存,這些庫存沒有辦法出貨,並且損害現金流;但沒關係,這些庫存將在 FY24Q4 出貨,所以 FY24Q4 營收將很強勁;還有液冷是新技術,現在就必須為 FY24Q4 和FY25Q1 的需求準備安全庫存,這也是先前進行資本融資的原因,這樣才能進行大筆採購,為 FY24Q4 的出貨做好準備。

Matt Bryson

Hi, thanks for taking my question. I would be thinking with liquid cooling ramping in fiscal Q4, and not to harp on the gross margin issue, but that you would be seeing a benefit to gross margins. And I guess my question is, is there any chance that either with the liquid cooling solutions or with your other solutions, that you're again seeing some penetration at those larger customers and specifically hyperscalers, and that's why we're seeing gross margins come down?

And I guess just one clarification for Dave. If you can provide the magnitude that revenues were affected by your inability to procure components in fiscal Q3? Thanks.

【Charles Liang】

Let me add a little bit. Because liquid cooling is new to us, so to speed up quick support for some of our very important customer on June quarter, indeed, we had to pay some premium to speed up the supply. So, we spend a bunch of [indiscernible].

【David Weigand】

Yeah. So, the two questions, Matt, I would say, first of all, to the gross margin question, again, I try to give a -- my philosophy is, give a conservative [indiscernible] to beat that. And we were able to do that in Q3 and we'll do everything we can do it -- can do to beat it in Q4. But it'll depend also on what we ship.

As to the magnitude of revenue, I'll go back to the fact that our backlog is at a record high. And so what that means is that every quarter we could have shipped more if we had more parts. And so therefore, it's an ongoing problem and we don't rely on that as an excuse. The fact of the matter is, we're glad to be able to produce the products that we're producing for some of the best companies in the world. And so, we continue -- we will continue to do that and we're very upbeat by the fact that the supply chain continues to improve each quarter.

【看圖說故事】SMCI 迴避直接給出確切的收入損失數字,但間接承認液冷技術的額外成本和供應鏈問題確實對毛利率造成一定的負面影響;不過,SMCI 也強調正努力克服問題,並對未來充滿信心,相信供應鏈問題會逐漸得到改善,同時再次強調強勁的市場需求和積極的應對措施,以此來提升投資信心;所以,市場對於 NVDA GPU 的需求仍然很高,持續處於供不應求的情況?

Q. 液冷技術的普及會帶動毛利率上升,但實際情況卻是毛利率下降,是否是因為公司為了打入大型客戶(特別是超大規模客戶)而採取降低價格的策略,才導致毛利率下降?而 FY24Q3 因為無法採購到關鍵零組件而損失多少收入?

A. 液冷技術對 SMCI 來說還比較新,為了在 FY24Q4 可以很快地支援一些非常重要的客戶,確實支付額外費用來加快供應速度,同時產品組合也會有影響;一般來說,SMCI 會提供一個保守展望,並努力超越它,將盡力在 FY24Q4 再次超越公司展望;目前積壓訂單處於歷史高位,如果有更多零組件,就可以出貨更多產品。因此,零組件是一個持續存在的問題,但每個季度都在持續改善,對未來感到非常樂觀。

Jon Tanwanteng

Hi, thanks for the follow-up. I was wondering if you could speak to your cash usage expectations over the next quarter or two. Are the proceeds from your recent capital raises all spoken for, as you look to the growth in the pipeline and record backlog you spoke to, or do you think that's more in reserve for growth further down the line?

【David Weigand】

Yeah. So, the way I would answer that is that, I hope that I have -- that I need more capital, Jon, because that means that we're booking -- that we're growing revenues even faster. So, we've got capital adequate to get us through the current market, which means today. But in a week, that -- we hope that that changes, and we hope that we've got orders that require even more capital. So, all I can say is I hope that -- I'm hoping for the needs for more capital.

【Charles Liang】

Yeah. We believe our revenue will continue to grow strong, and that's why we need more capital to grow faster. If we grow 20%, 30%, we may have enough capital now. But if we grow much faster, then for sure, we need more capital to grow stronger.

【看圖說故事】分析師想了解 SMCI 的資金運用策略,以及如何平衡短期需求和長期發展目標,SMCI 並沒有直接回答關於資金用途的具體細節,而是巧妙地將話題轉移到對未來成長的期許上,顯示對公司的發展前景充滿信心,並相信未來的增長會帶來更大的資金需求;但是否也暗示,如果沒有進一步的資金挹注,成長率只能夠有 20-30%?而近期股價下跌,可能也是因為擔心 SMCI 將持續發可轉債或是新股?發可轉債短期對於稀釋獲利的影響有限,但發新股的影響就會比較大了;

Q. 未來一到兩個季度對現金使用的預期?近期募資所得是否都已規劃好用途、將用於滿足現有的成長需求?或是將其作為儲備,以應對更長遠的未來成長?因為你們有提到未來成長和創紀錄的積壓訂單。

A. 目前資金充足,足以應付當前的市場需求,以及 20% - 30% 左右的成長 ,但是相信、同時也希望未來能成長更快,因此可能需要更多資金來加速成長。

Nehal Chokshi

Hey, thanks. Thanks for the follow-up question. This is for Charles. Charles, with the capital base that you have now -- and I hear you, Dave, that you hope that you will need more capital. But with the capital base that you have now, technology advantage that you've always had that you've added to, is there anything else that you need in order to become the number one server vendor?

【Charles Liang】

Yes. Indeed, our plan is very ambitious. Let me use that word. We have a very ambitious brand, so we try to continue grow very strong, kind of 3 times to 5 times faster than our industry's average. So, when that case happen, and we believe so, we hope so, then for sure we need more capital.

【看圖說故事】過去 12 個月的成長率是產業平均的 5 倍以上,暗示未來可能會降到 3- 5 倍?那麼市場的估值是否就會被調整?

Q. 以現在的資本基礎與技術優勢,還需要什麼才能成為伺服器供應商的龍頭?

A. SMCI 野心勃勃,成長非常強勁,成長率是產業平均的 3 - 5 倍,因此需要更多的資金。

【看圖說故事】

NVDA:SMCI 將在 FY24Q4 (2024年 3 月 - 6 月)出貨 1000 組液冷機櫃給最先進的客戶,甚至強調 10 萬瓦的機櫃已準備就緒,在 SMCI 與 NVDA 關係良好的前提下,是否暗示至少有 NVDA B200 以上 (B100 仍只需要 70 千瓦)的液冷機櫃將於 2024年 3 月 - 6 月期間出貨,對於 NVDA 即將於 5 月 22 日公布的FY25Q1 是否會有所幫助?

新客戶:與 NVDA 的良好關係,搭配 SMCI 快速上市的競爭優勢,持續為 SMCI 贏得新客戶,營收規模可望持續擴大 。

營收成長:未來幾季將淡季不淡,並呈現季增走勢,年營收達到 200 億應無懸念,但市場在意的仍是高速成長將維持多久?

獲利能力:儘管快速上市的競爭優勢,加上馬來西亞廠區投產,以及新平台和液冷技術的應用等技術優勢,有助於在市場競爭中保持領先,並提供提升毛利率的機會 ,但是 AI 市場的快速變化,尤其是 NVDA 的供應趨於順暢,更進一步放大市場競爭,使得毛利率預測變得更加困難,因此需要非常努力地在價格和毛利率之間取得平衡。

籌資需求:提升獲利能力的關鍵之一是提升規模經濟,這需要更多的資金,不論是發債或者是發新股,都將稀釋獲利,不利股價表現 。

短期而言,資金需求有利市占率,但不利 EPS 與估值;長期而言,市場競爭將影響成長,都是 SMCI 將面臨的考驗。